NYC Deli Insurance

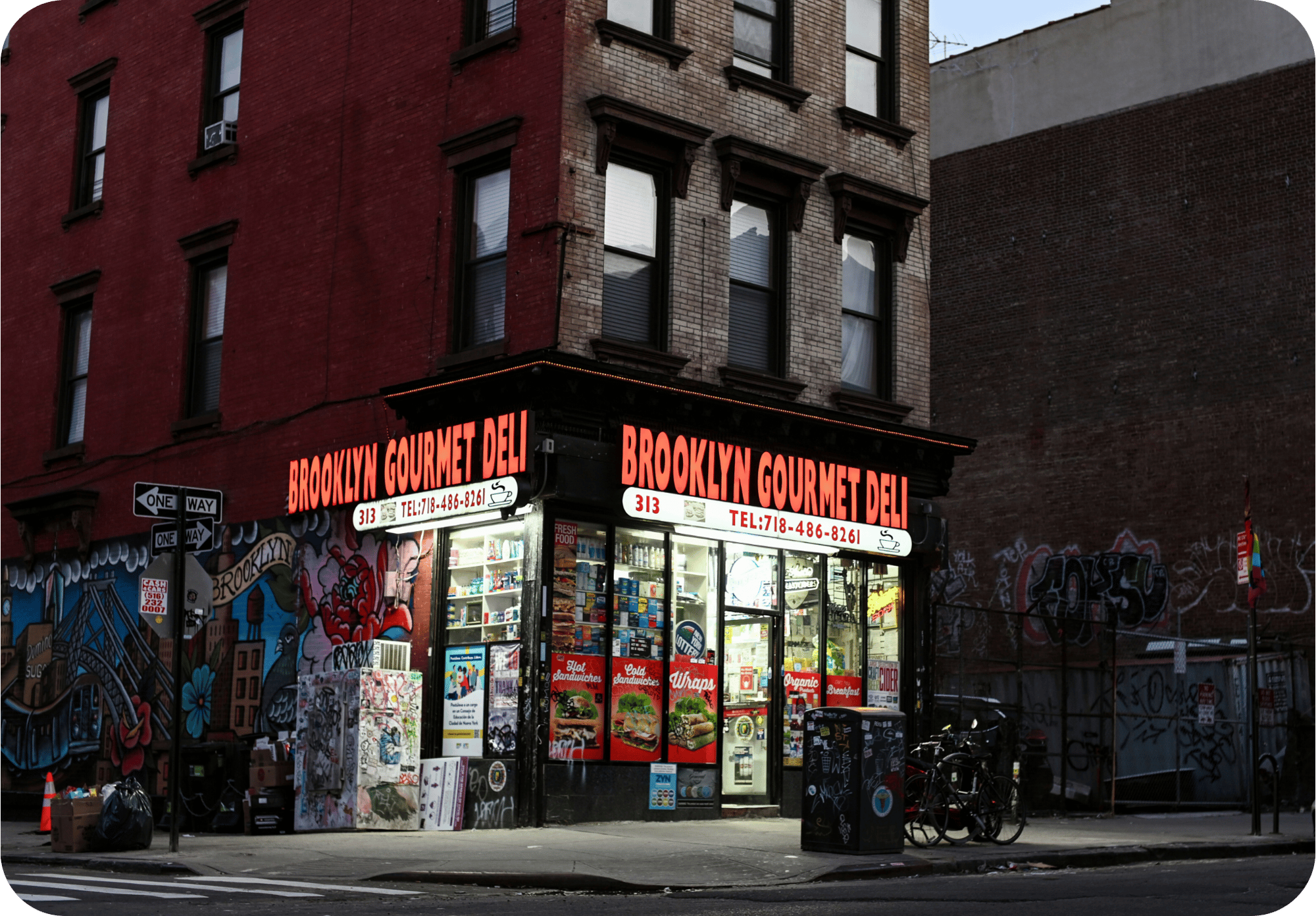

Running a deli in New York City means long hours, loyal customers, and fierce competition. From Manhattan bodegas serving breakfast rush commuters to Brooklyn sandwich shops and Queens corner delis, every day brings unique challenges.

At Insure My Deli, we specialize in protecting NYC deli owners with insurance packages built for the pace, property costs, and risks of doing business in the five boroughs.

Coverage Designed for NYC Delis

Protection Built For NYC Delis From Bodegas to Sandwich Shops

Business Owners Policy (BOP)

Protects your property, inventory, and equipment from fire, theft, vandalism, and more.

Workers’ Compensation

Covers your staff for workplace injuries, from the counter to the kitchen.

Cyber Liability

Defends against POS hacks, ransomware, and online ordering breaches.

Business Interruption

Replaces lost income if you need to shut down temporarily due to a covered claim.

Equipment Breakdown & Food Spoilage

Protects your refrigeration, ovens, and food inventory.

General Liability

Protects against customer injury claims and accidental damage to others’ property.

Commercial Auto

Insures vehicles used for deliveries, catering, or supply runs.

Employment Practices Liability Insurance

Protects against employee claims of wrongful termination, discrimination, or harassment.

Why NYC Deli Owners Choose Us

At Insure My Deli, we make the process fast and simple, delivering custom quotes in as little as five minutes. Plus, when you bundle your coverages, you can save up to 25% while protecting every part of your business.

What insurance does a deli in New York City need?

Most NYC delis carry a Business Owners Policy (BOP) for property and liability, Workers’ Compensation for employees, and additional coverage for equipment breakdown, food spoilage, and business interruption. These coverages protect against the most common risks deli owners face in New York.

How much does deli insurance cost in NYC?

Most NYC delis pay between $3,000 and $7,500 per year for a Businessowners Policy (BOP). A small Bronx bodega with 2–3 employees may be closer to the low end, while a larger Manhattan or Brooklyn deli with catering or delivery services will be higher. Bundling BOP, Workers’ Comp, and spoilage coverage can cut costs by 15–25%.

Do you insure both bodegas and sandwich shops in New York?

Yes! Insure My Deli specializes in insuring all types of delis, from Manhattan bodegas to Brooklyn sandwich shops to family-run delis in Queens and the Bronx. If it’s a deli in New York City, we can design coverage for it.

Can deli insurance in NYC cover spoiled food?

Absolutely. With equipment breakdown and food spoilage coverage helps deli owners recover financially when refrigeration units, freezers, or ovens fail, leading to lost perishable inventory.

What if my deli in NYC has to close temporarily after a fire or storm?

Business interruption coverage replaces lost income and helps pay bills and payroll while your deli is shut down for repairs from a covered loss. In New York City, where even a short closure can cost thousands, this coverage is critical.

How quickly can I get a deli insurance quote in NYC?

Most deli owners receive a custom quote in 5 minutes or less. At Insure My Deli, we make the process simple so you can get covered quickly and get back to running your deli.

.png?width=1333&height=2000&name=Untitled%20design%20(6).png)

Get Your NYC Deli Covered Today

At Insure My Deli, we combine local expertise with the leading insurance companies in the country to deliver fast quotes, tailored coverage, and savings of up to 25%. Whether you own a bodega in Manhattan or a sandwich shop in Brooklyn, we’ll help you find the right protection for your business in just minutes.